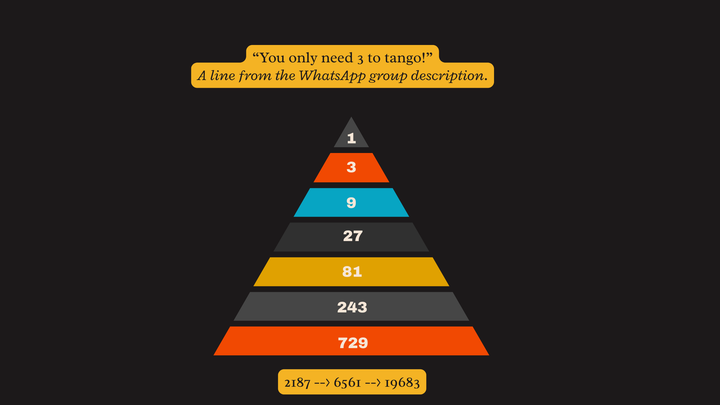

Africa Deserves Better: My Encounter with a Ponzi Scheme in Disguise

On Friday, 05 September 2025, a LinkedIn post caught my attention with a familiar promise of “financial freedom.” As a creative in the finance space l was curious to know what this was all about. One of the conversations l have with myself constantly when thinking about my finance content