Simulating a junior equities trader at Standard Bank Global.

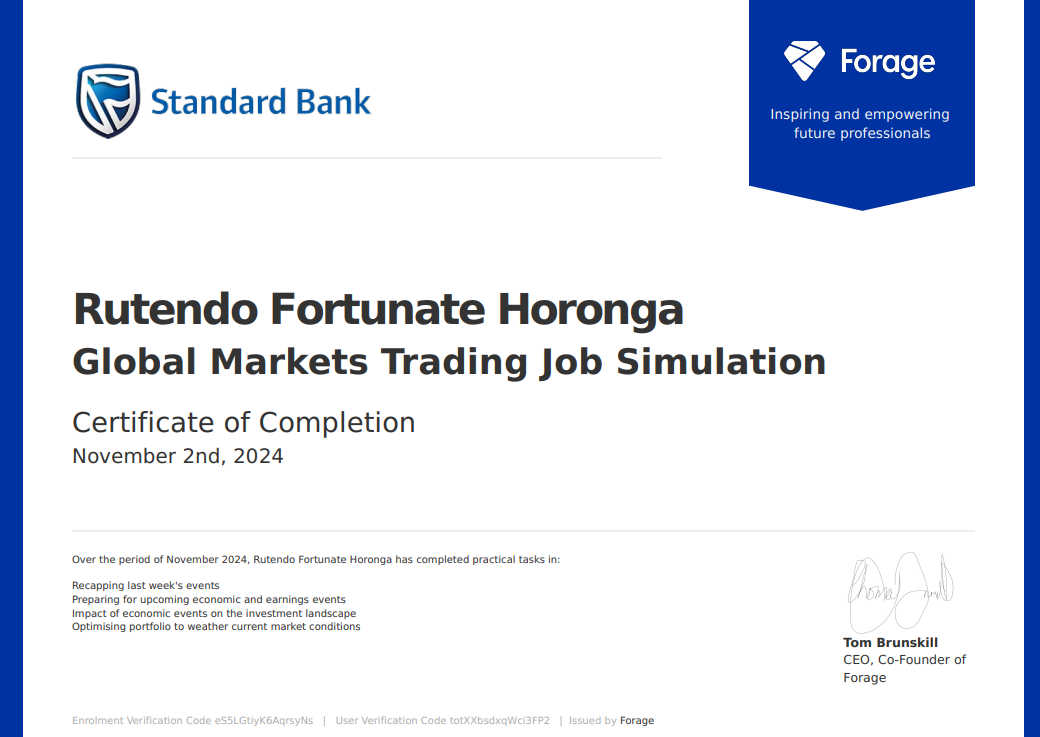

In an era of persistent inflation uncertainty, geopolitical tension, and regulatory reform, the ability to interpret macroeconomic signals has become a defining skill for global markets professionals. That was the central lesson I took from completing the four-hour Standard Bank Global Markets Trading job simulation hosted on Forage, an exercise designed to mirror the real-world demands of a junior equities trader.

Originally published in November 2024, this updated analysis revisits the simulation’s core tasks using more recent market data. It is not intended as financial advice. Rather, it serves as a practical reflection on the mechanics of equity trading and an encouragement to others who have completed similar programs to continue sharpening their market analysis with live information.

How Global Markets Desks Frame the Week

On a global markets trading desk, the week typically begins with a review of key developments from the previous days and a forward look at events likely to influence asset prices. These discussions spanning economic releases, political developments, and regulatory signals equip traders to engage clients with context-driven, informed views.

As part of the simulation, my first task was to identify and summarize major global events from the preceding week that could be relevant to a bank with international exposure such as Standard Bank.

Key Market Developments

Several themes stood out.

In the United States, year-on-year inflation eased to 2.1%, moving closer to the Federal Reserve’s long-term target. The Personal Consumption Expenditures (PCE) index rose by 0.3%, in line with expectations. Services inflation remained firm, while goods prices declined for the fourth time in five months, highlighting ongoing disinflation in certain segments of the economy. Housing costs edged higher, while energy prices fell sharply.

Bond markets, however, told a more complex story. US Treasury yields initially dipped following weak October jobs data distorted by industrial action and extreme weather but later climbed. The benchmark 10-year yield rose to around 4.36%, marking its highest level since early July and capping the largest monthly rise in yields since April. Strategists pointed to concerns about the US fiscal outlook, noting that debt dynamics could worsen regardless of the outcome of the presidential election.

In Europe, inflation surprised to the upside. Eurozone consumer prices rose 2.0% year-on-year in October, above both September’s reading and market expectations, complicating the European Central Bank’s policy calculus.

Meanwhile, in Switzerland, UBS continued to await the implementation of stricter “too big to fail” regulations proposed after the collapse of Credit Suisse. The reforms aim to strengthen financial stability but could have lasting implications for the profitability and balance-sheet flexibility of Europe’s largest banks.

What Lies Ahead: Events and Earnings

The second phase of the exercise involved scanning economic and earnings calendars to identify upcoming events with potential portfolio impact.

Among the most closely watched were the US presidential election and the subsequent Federal Open Market Committee (FOMC) meeting, both of which carried the potential to reshape expectations around fiscal and monetary policy. In the UK, attention turned to the Bank of England’s Monetary Policy Report, while the euro area calendar appeared relatively light.

On the corporate side, December earnings from Micron Technology and Accenture were flagged as indicators of broader trends in technology demand and corporate spending. One company, Ocado, was deliberately excluded from further analysis due to sustained weak performance, prolonged losses, and deteriorating fundamentals, illustrating the importance of disciplined stock selection.

Interpreting the Implications

Taken together, these developments underscore the interconnected nature of modern markets.

Easing US inflation suggests the Federal Reserve may proceed cautiously on rate cuts, supporting interest-rate-sensitive sectors such as real estate and services. At the same time, elevated bond yields increase competition for equities, particularly in growth sectors like technology.

Fiscal uncertainty in the US adds another layer of volatility, reinforcing demand for perceived safe-haven assets during periods of political risk. In Europe, firmer inflation complicates the outlook for monetary easing, while tighter banking regulation could constrain returns in the financial sector even as it enhances systemic stability.

From Analysis to Decision-Making

The final task in the simulation involves translating macroeconomic insight into actionable investment views. This includes preparing a slide deck with one buy and one sell recommendation supported by data, valuation metrics, and risk analysis for senior portfolio managers. In my case, the focus was on US-listed stocks, including Coca-Cola and Tesla, as a way of contrasting defensive and growth-oriented investment profiles.

While simulated, the exercise reflects a core reality of equities trading: success depends not only on understanding individual companies but also on interpreting how global economic forces, policy decisions, and regulatory shifts shape market behavior.

As financial markets continue to navigate uncertainty, experiences like this simulation offer a valuable, grounded introduction to the analytical discipline required on a global trading desk and a reminder that markets are, above all, a reflection of the world in which they operate.